Can The Executor Disburse Funds To Himself For Inheritance Money

When you first start working out your overall budget, it's normal to include calculations for the obvious things like rent, student loan payments and even groceries. But there's another important provision you'll want to add to the list that might not be as straightforward: an emergency fund. It's impossible to anticipate unexpected expenses in your life, but having money set aside specifically for this purpose — money that isn't already allocated to other bills — can make the difference in weathering an emergency smoothly or setting yourself up for financial difficulties down the road.

Emergency funds are great safety nets to have, not only for your financial stability but also for your own peace of mind. If you don't have one yet, find out why an emergency fund should be a part of your budget — and how you can build your own.

CNBC reports that, according to a January 2021 survey, only 39% of participants indicated they could comfortably cover an unexpected expense of $1,000. That's fewer than four in 10 Americans. Those who said they couldn't pay the expense outright would resort to other methods like using a credit card and paying the debt off in increments (while incurring interest charges). Others said they might borrow money from family or friends.

Financial emergencies, like a sudden illness, an unexpected job loss or even something that doesn't cost as much as $1,000, can cause your finances to take a major hit. Even repairs on your car or your home can set you back a pretty penny if you aren't prepared. That's where having an emergency fund comes in handy.

An emergency fund is money you've set aside in a separate savings account to help cover or offset the expense of an unforeseen circumstance. People often confuse emergency funds with their nest egg for retirement or long-term savings for tuition or a new home. But this specific fund is a financial safety net. You'll only use it when an unexpected expense pops up, not any other time or for a planned purchase or investment.

Emergency Funds Should Reflect Your Current Lifestyle

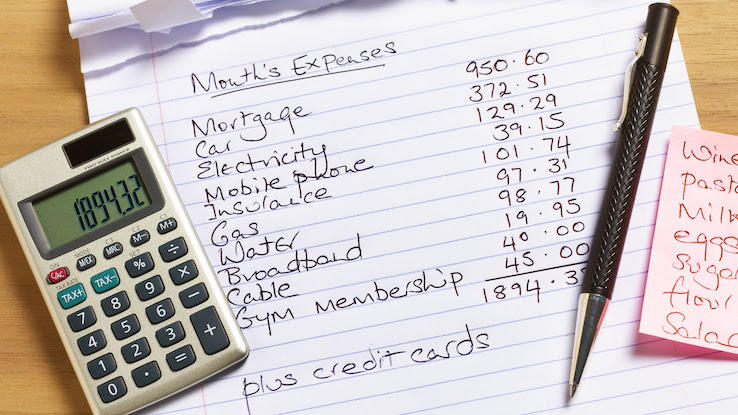

When it comes to the size of an emergency fund, most experts say that the general rule of thumb is to save up three to six months' worth of living expenses. That amount won't be the same across the board for everyone. You may be able to save more money than others as different life factors come into play, or you may find yourself saving up within a different time frame.

While saving as much money as you can is vital, the size of your emergency fund will largely depend on your current lifestyle, income and monthly expenses. Another significant factor to consider is dependents that rely on your income as well. You may need to adjust the amount you save based on your current obligations.

The amount you save can vary depending on other factors, too. Three to four months' worth of expenses could be enough if you don't have much debt, you're relatively healthy with no medical bills, you rent your home and you have a steady job. You might save up to six months' worth of expenses (or perhaps even a year's worth) if you live in a high cost-of-living area, own your own home or have children or other dependents (including furry ones!).

Having an Emergency Fund Can Be Vital for Your Financial Security

If you haven't considered putting away some savings for emergencies, it's never too late (or early) to start. Of course, it's easier to bounce back from financial setbacks if you have a safety net to cover expenses rather than relying on credit or loans. Having that fund can keep you from being tempted to use other long-term savings, like retirement funds, to cover unexpected costs. Making those decisions that compromise other areas of your finances could end up setting you back in the long run.

Aside from having financial security, there are other benefits to having an emergency fund. Saving money helps to keep your stress levels down. Finances can be a source of stress and anxiety, which can impact your mental health in the long run. Being prepared for unexpected events can provide some relief in the form of peace of mind. An emergency fund can also help you limit unchecked spending by providing a goal to work towards. When you commit to saving money each week or month, you may be able to make better financial decisions because you'll need to weigh the pros and cons of a purchase more carefully.

How You Can Build up an Emergency Fund

Creating an emergency fund doesn't have to be complicated — but it does require some discipline and consistency. If you're not in the habit of actively setting aside money for savings yet, here are some ideas to get you started.

When first creating a savings plan, begin by identifying how much you can afford to save. This is where a personal budget comes in handy. Evaluate your necessary expenses, including your mortgage or rent, utilities, food, debt and other regular costs. Then, take a look at expenses you could dial back on or cut completely. These often fall into categories like entertainment, dining out or shopping for nonessential items. It's possible that you could start saving some money just by cutting out one unnecessary expense a month, like an unused gym membership or the cable TV you never watch.

Once you identify how much you'll be able to save each month, commit to make savings a habit. You can set up a reminder on your phone to put aside a certain amount of money from your paycheck. If you're a little bolder, set up an automatic recurring transfer from your checking account to another account on payday.

Another great strategy is to take advantage of one-time saving opportunities. There are certain times when you may get a lump sum of money that you don't have to spend on bills. For example, many Americans get tax refunds after filing taxes each year. That's an opportunity to tuck some money away in your emergency fund. You may also save money you receive as a bonus from your job.

Additionally, it may help you to set interval goals along the way to your total overall savings goal. For example, you might set a goal of saving up $1,000, and then reassessing your financial situation to see how you can change your approach to building the fund. Reaching these smaller milestones can also give you the motivation to continue.

Lastly, where you keep your emergency fund matters. Don't be tempted to keep emergency money in your everyday checking account, or even in the savings account that's attached to your everyday checking account. It's important that you have easy access to the fund when you do need it, but you also don't want to face temptation to use it for non-emergencies. Instead, keep it in a high-yield savings account. These bank accounts pay higher interest rates than typical savings accounts, meaning you earn higher returns on the money you keep in them.

Remember that it's okay to start small — your fund probably won't appear overnight. Saving a small but consistent amount each month can add up and assist you with emergency expenses that come up.

MORE FROM ASKMONEY.COM

Can The Executor Disburse Funds To Himself For Inheritance Money

Source: https://www.askmoney.com/budgeting/what-is-emergency-fund?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: millershavoind.blogspot.com

0 Response to "Can The Executor Disburse Funds To Himself For Inheritance Money"

Post a Comment